Carried out in 2014 in a joint initiative by the German Federal Association of the Pharmaceutical Industry (BPI) and Homburg & Partner (H&P), an internationally operating management consultancy, an up-to-date study recently confirmed central market trends in the pharmaceutical industry.

Decision-makers from the pharmaceutical industry feel that dynamic health policy environment leaves only little room for strategic development of the industry – market view provides a lot of tasks for the pharmaceutical industry in Germany

Authors: Dr. Matthias Staritz (H&P), Dr. Matthias J. Kaiser (H&P), Dr. Katja Gehrke (BPI)

The idea of the study concept is to combine a meta-analysis of available and profound study sources regarding future trends with an online survey presented to pharma decision-makers. The combination of both market research forms delivers a valid picture of the current future trends and steps to be prepared on pharma market challenges in Germany.

I. Meta-Analysis Study

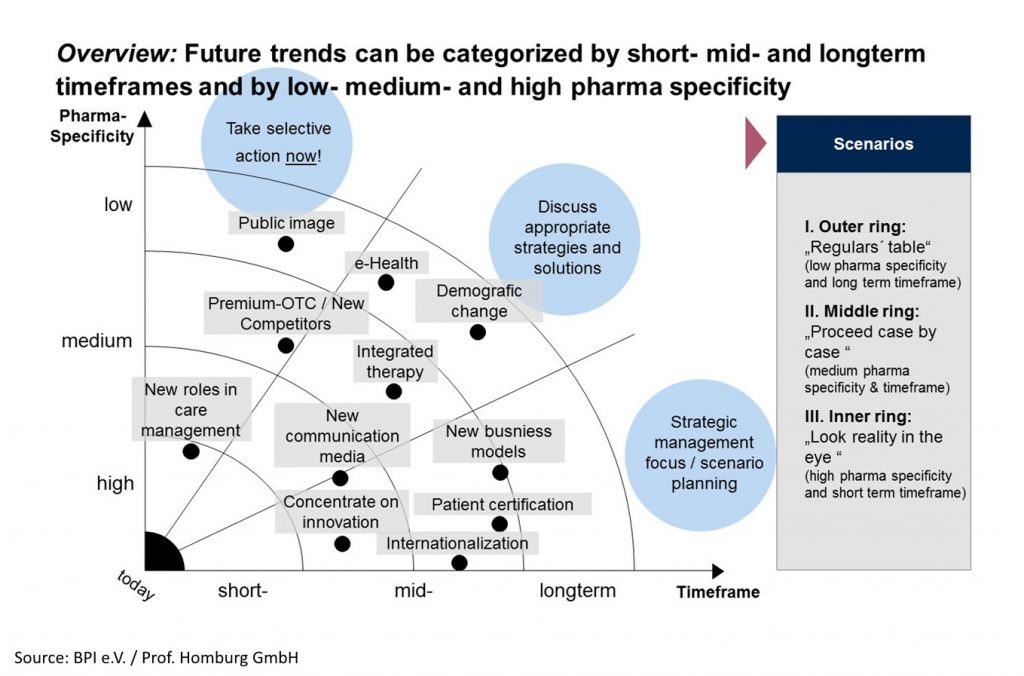

The graphics summarizes results of the “external view at pharma trends” into a main cluster of pharma future in the dimensions of time and pharma specify.

The aspects shown above are taken from future trends related to several relevant target groups of the German healthcare market (e.g. patients, physicians, payers, purveyor, politics). Rethinking these clusters, various challenges must be tackled in the pharmaceutical industry in Germany:

- Image Perception: Pharma has to improve its image and perception (“We Care!”) and co-create the future environment by individualized, intensive networking

- Innovation Flexibility: R&D productivity and efficiency has to be improved to create real innovations and a slim lined and always flexible organizational structure has to be implemented, in order to react and adapt to rapidly changing markets

- Business Model: Radically adapt business models, innovation and distribution models in line with the market to changing market situations and outsource non-core activities as well as pursue strategic alliances

- Internationalization: Exploit market potential in emerging economies with products and business models that are adapted to local demand and evaluate international positioning for worldwide benefit assessment

- Patient Focus: Invest in direct communication with patients by utilizing healthcare IT and generally improve patient’s welfare. Moreover, document the results and work towards optimizing clinical pathways

- Data Understanding: Generate necessary data for cost-benefit-analyses with authorities and develop the ability to process large quantities of data (e.g. Real-Life-data)

- Sales Activities: Adjust sales models to current demand (multi-channel-strategy, more key account management) and make investment decisions to strive for long-term amortization and cooperation

II. Primary Market Research Study

Over hundred various decision-makers from German OTC and Rx pharma companies were asked about the current mood and challenges of the market as well as their assessment of the top trends and policies for the next ten years. Based on the analyses of 97 responses from Managing Directors (71%) and Executives from Marketing & Sales (25%), the summary of the study for the German pharma market shows the following trends:

1. The current business climate in the pharmaceutical industry is considered mediocre with a grading of 3.84 based on a German grading system (1 [very good] – 6 [fail]); the business situation of the own company tends to be evaluated more positively. Compared to the last survey in early 2013, the business climate has not improved. With almost one grade difference, the international business situation is rated significantly more positive with 2.97.

2. Business expectations for the next 3 years are only slightly better. They are being marred by “restrictive politics”, “strong regulations and AMNOG (act for restructuring the German drug market)” and the “price moratorium”. On an international scale, political circumstances are also mentioned as a particularly negative influence; however, due to the growth opportunities outside of Germany, the overall assessment on an international level is significantly better. Differences in the evaluation of individual product groups are substantial: Among all product and service groups, orphan drugs are evaluated most positively with regard to their economic development. Generics and Rx, on the other hand, have rather low growth opportunities according to German decision-makers.

3. Regulatory measures and regulatory intervention in the market, in particular with regard to price and volume control as well as the market power of health insurers are considered as the biggest challenges – mostly because of their variety and parallelism.

4. Key trends in the pharmaceutical market for the next ten years include growing market access barriers, the worldwide establishment of cost containment, as well as rising complexity in the implementation of regulatory requirements. The top trends are assessed similarly regardless of company size, business area and enterprise age.

5. To prepare for these trends, companies mostly see a need to react when it comes to expanding their product range, including a strong focus on innovation to secure their future existence. In addition, a closer integration of departments (product development, marketing, market access, medical and regulatory affairs etc.) is mentioned as an important response to regulations. The development of foreign markets has been identified as another top measure in this context. Companies hope that foreign markets will compensate for the modest developments on the German market.

The combination of both study results present a comprehensive and valid picture of the future pharma market in Germany. The studies describe current challenges, future trends and derive arrangements to ensure each companies market performance in the future. Pharma companies as well as the BPI can mirror actual activities; the comparison helps to overcome challenges and made best strategic decisions.